The ATS VX9 Trading System – High Performance Fully Automated Night and Day Trading NQ and MNQ

The VX9 wakes up before sunrise and finds the best trading opportunities in the morning twilight. Built from scratch to be a true day trading system, the VX9 offers simplicity and performance.

Unique characteristics of the VX9 Trading System

- Specializes in night and day trading the NQ and MNQ stock index futures contracts

- Gets positioned early, well before the cash market

- Utilizes price action trend multiple ways depending on market conditions

- Executes small and medium sized trades as well as capturing the big move of the day

- Avoids trading during dangerous time spans that occur daily and weekly

- Automatically reads the news and adjusts trading accordingly

Features of the VX9 Trading System

- Fully Automated trading using the provided NinjaTrader® VX9 NinjaScript® strategy

- Easy to use: place the VX9 strategy on a one minute chart and enable on your account

- VX9 indicator can be used in real time to let you know if a possible trade is coming up

- Back testable in NinjaTrader® Strategy Analyzer® and Market Replay®

Development Methodology

The VX9 algo was developed by exposing it to long periods of market data.

Unlike other trading systems the VX9 is:

- NOT optimized

- NOT curve fit

No parameter updates or optimizations need be applied by the user.

How it Trades

The VX9 looks for strong trend conditions to develop and will either take a position in the direction of the trend or will take a position against the trend if price has moved overly sharply in the trend direction.

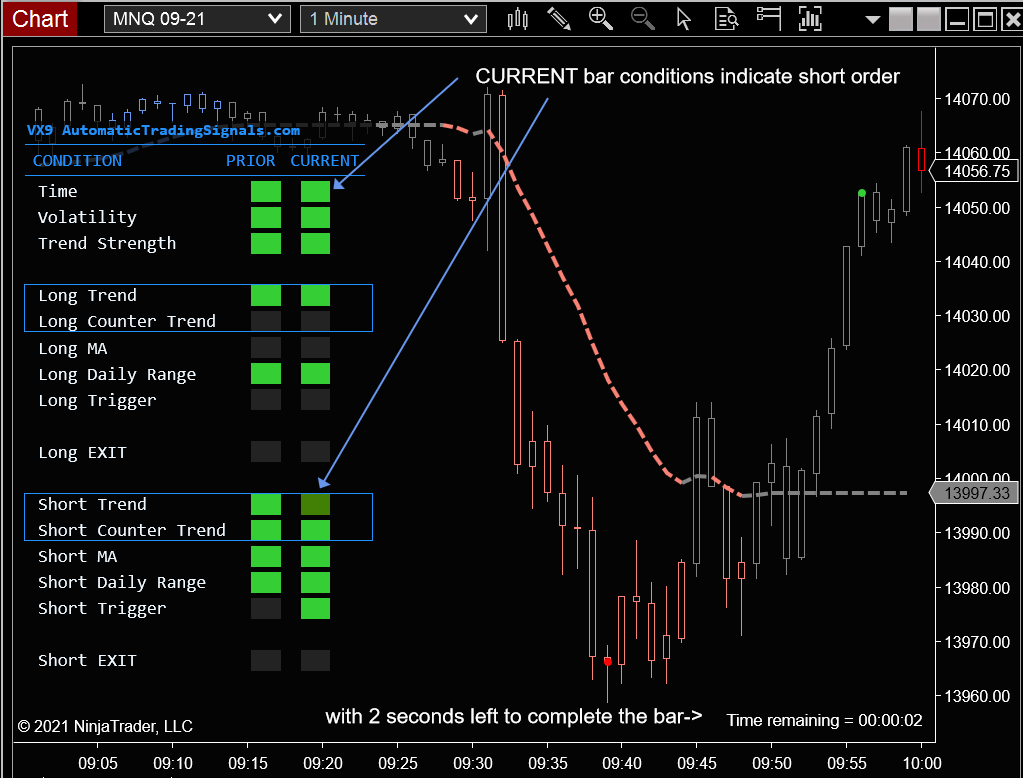

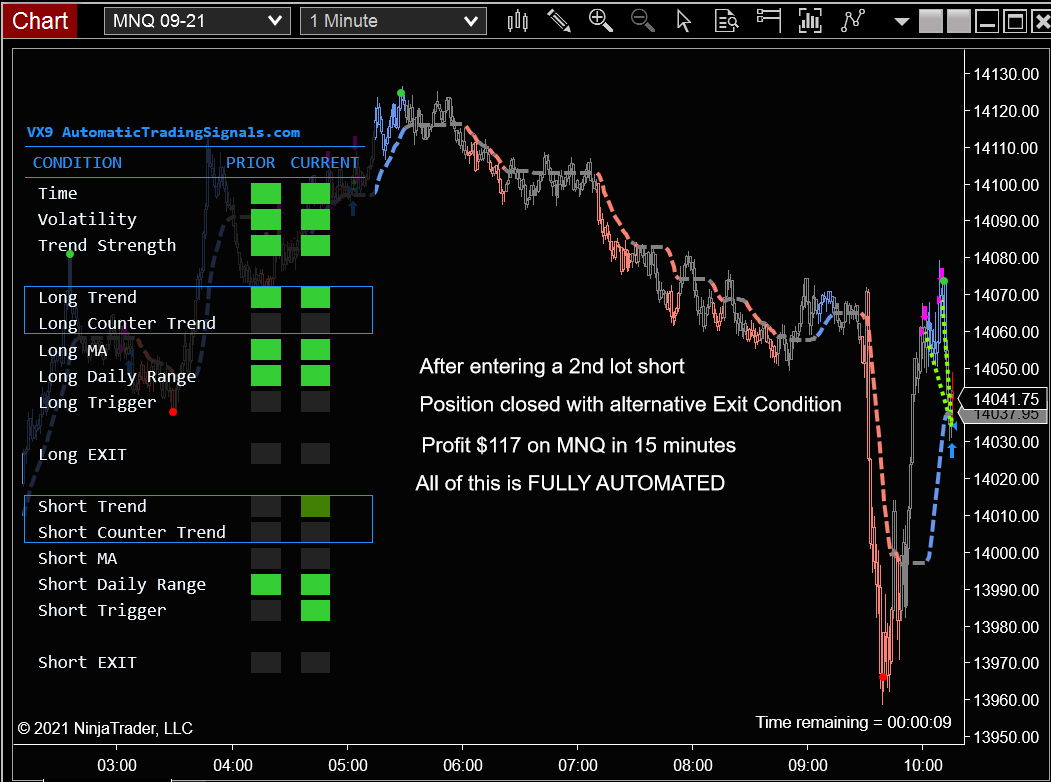

A short counter trend trade example

DEMONSTRATION VIDEO

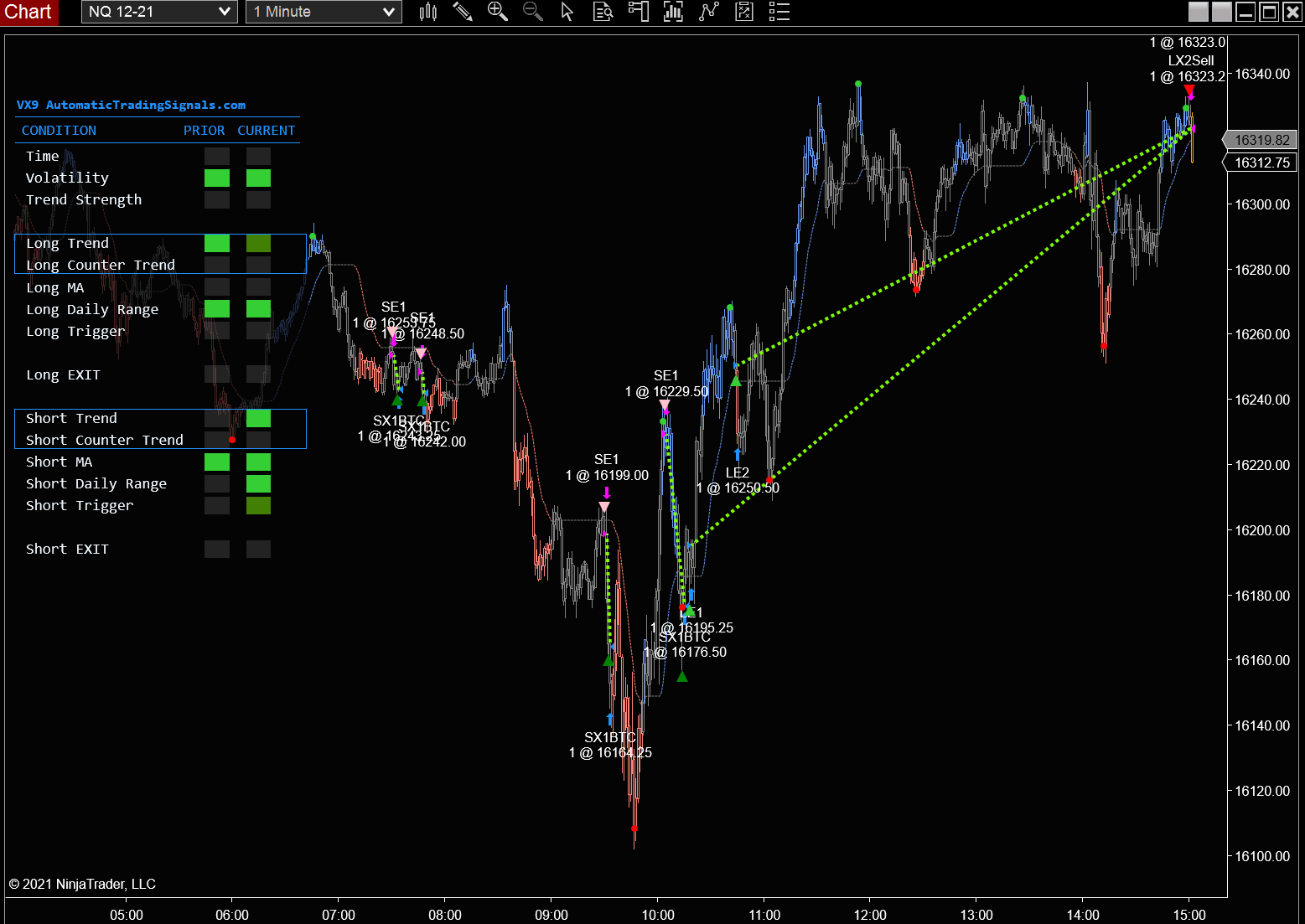

A TRADING DAY EXAMPLE

CURRENT PERFORMANCE

No tricks - Performance metrics include commissions and slippage.

BELOW: Cumulative Net Profit trading ONE or TWO MNQ contracts (micro e-mini NASDAQ 100 Index) per trade.

(using supplied template MNQ_Monthly_PR-01_2025)

Contract: MNQ 12-25. Trade List

HISTORICAL PERFORMANCE

No tricks - Performance metrics include commissions and slippage.

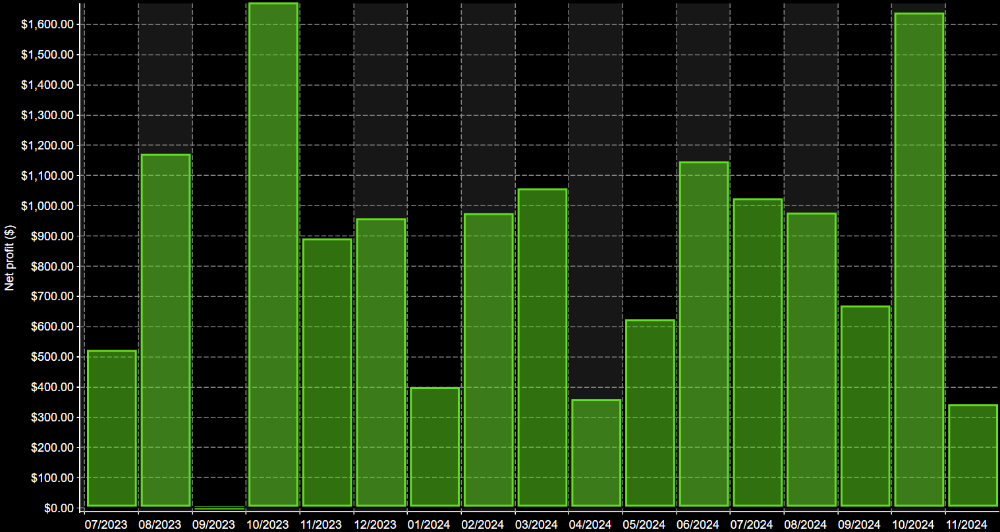

BELOW: MONTHLY NET PROFIT TRADING ONE to TWO MNQ CONTRACTS (micro e-mini NASDAQ 100 Index) PER TRADE. RESULTS INCLUDE COMMISSIONS AND SLIPPAGE. FIRST TRADE JULY, 2023. LAST TRADE NOVEMBER, 2024:

Contract: MNQ 12-24. Trade List

(results acheived using template MNQ_Monthly_PR-01_2024 provided)

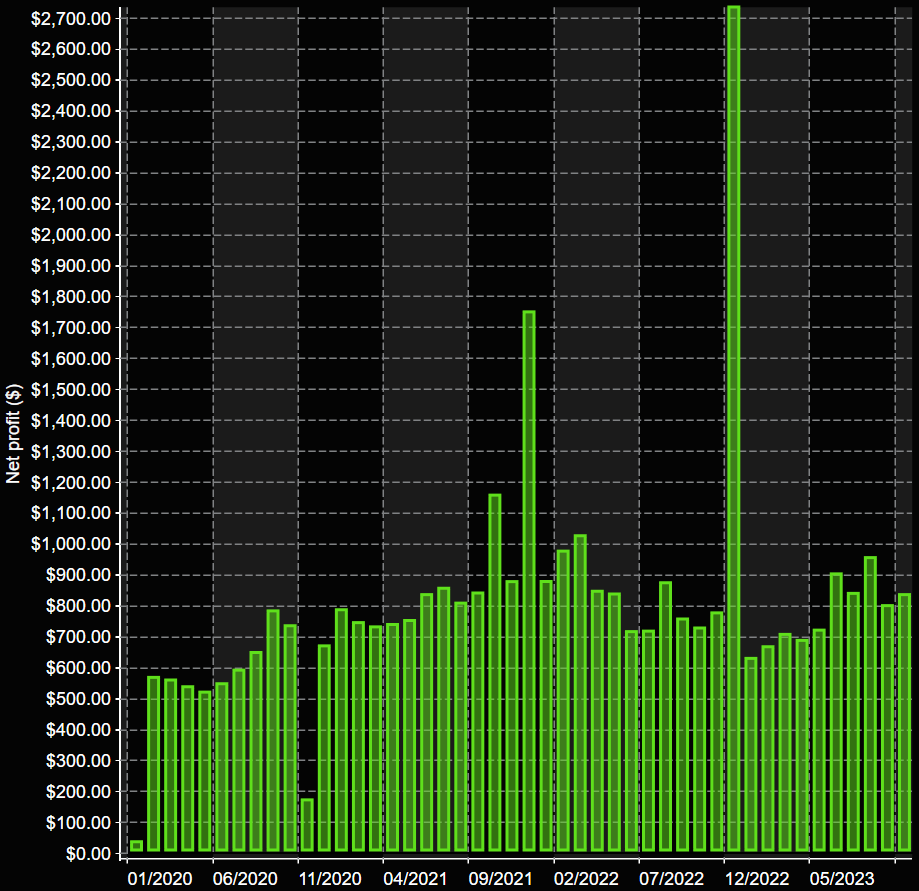

Trades frequently. In a 4 year historical analysis the system generated over 2,000 trades for an average of approx 2 trades per trading day.

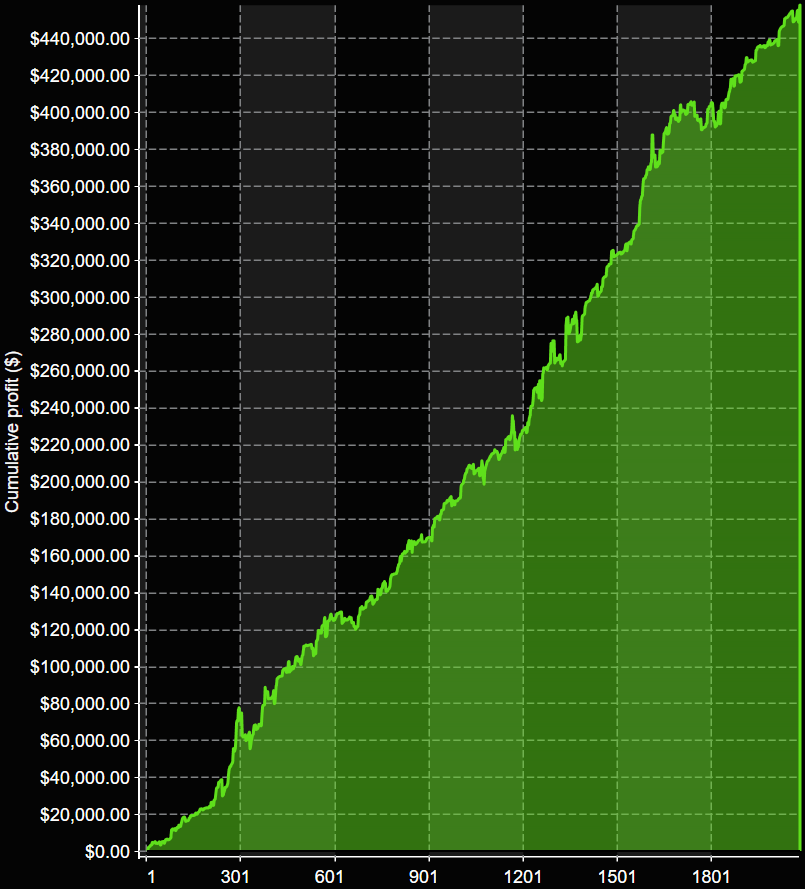

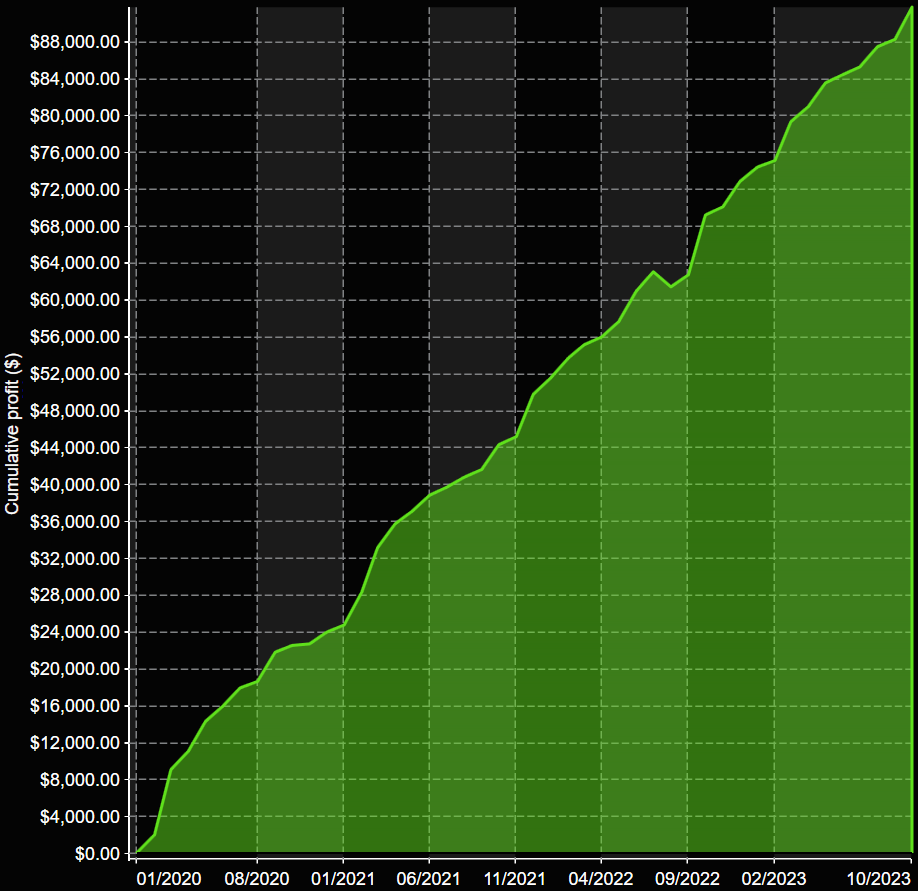

BELOW: CUMMULATIVE NET PROFIT TRADING ONE to TWO NQ CONTRACTS (e-mini NASDAQ 100 Index) PER TRADE. RESULTS INCLUDE COMMISSIONS AND SLIPPAGE. FIRST TRADE MAY 5TH, 2019. LAST TRADE OCTOBER 6, 2023.

Contract: NQ 12-23. Trade List

HISTORICAL PERFORMANCE - SMALL ACCOUNTS

Small accounts can trade the MNQ (the micro E-mini Nasdaq) using the VX9.

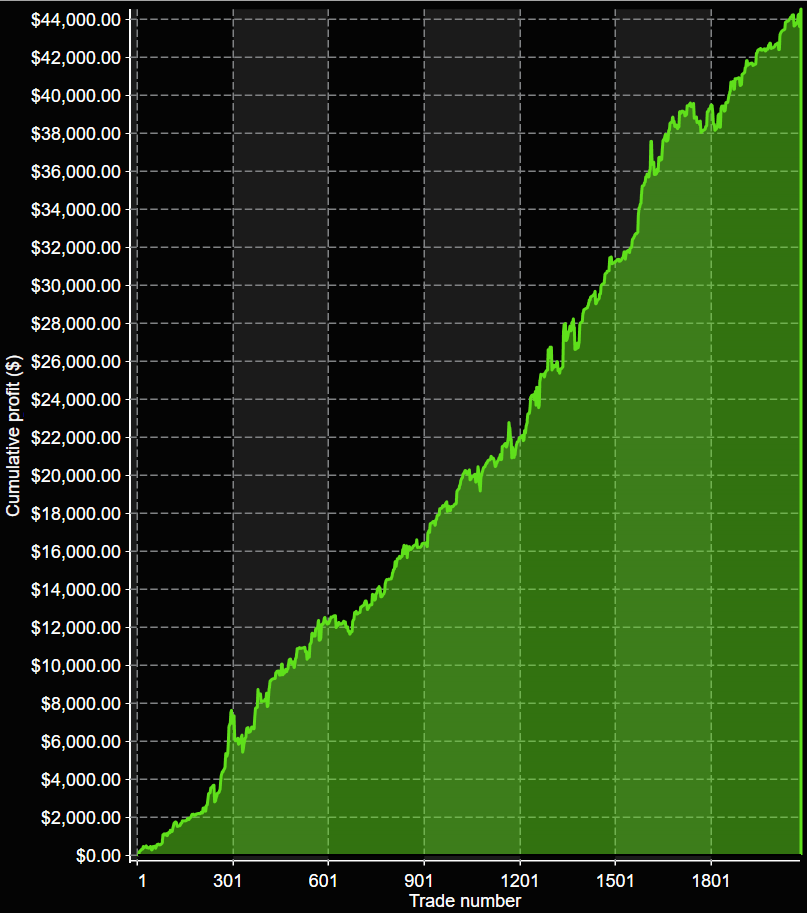

BELOW: CUMMULATIVE NET PROFIT TRADING ONE to TWO MNQ CONTRACTS (micro e-mini NASDAQ 100 Index) PER TRADE. RESULTS INCLUDE COMMISSIONS AND SLIPPAGE. FIRST TRADE MAY 5TH, 2019. LAST TRADE OCTOBER 6, 2023.

Contract: MNQ 12-23. Trade List

Monthly Income

The VX9 can be run in a conservative mode that focuses on monthly returns. In these examples we'll continue to use the micro contract, the MNQ contract that specifies a $2 point value.

Here we see the AtsVX9 setup with a monthly PnL template (VX9v6_MNQ_MONTHLY template 2023-10-13.xml included) trading "5 plus 5" MNQ contracts. 5 contracts for entry 1, and 5 for entry 2. Slippage and commission included.

MPnL 5+5:

Contract: MNQ 12-23. Trade List

The VX9v6_MNQ_MONTHLY_IG5 template (included) is a more aggressive version that goes for more trades

MPnLID 5+5. Slippage and commission included.

Contract: MNQ 12-23. Trade List

There's no minimum contract requirement. You can trade as few as one contract.

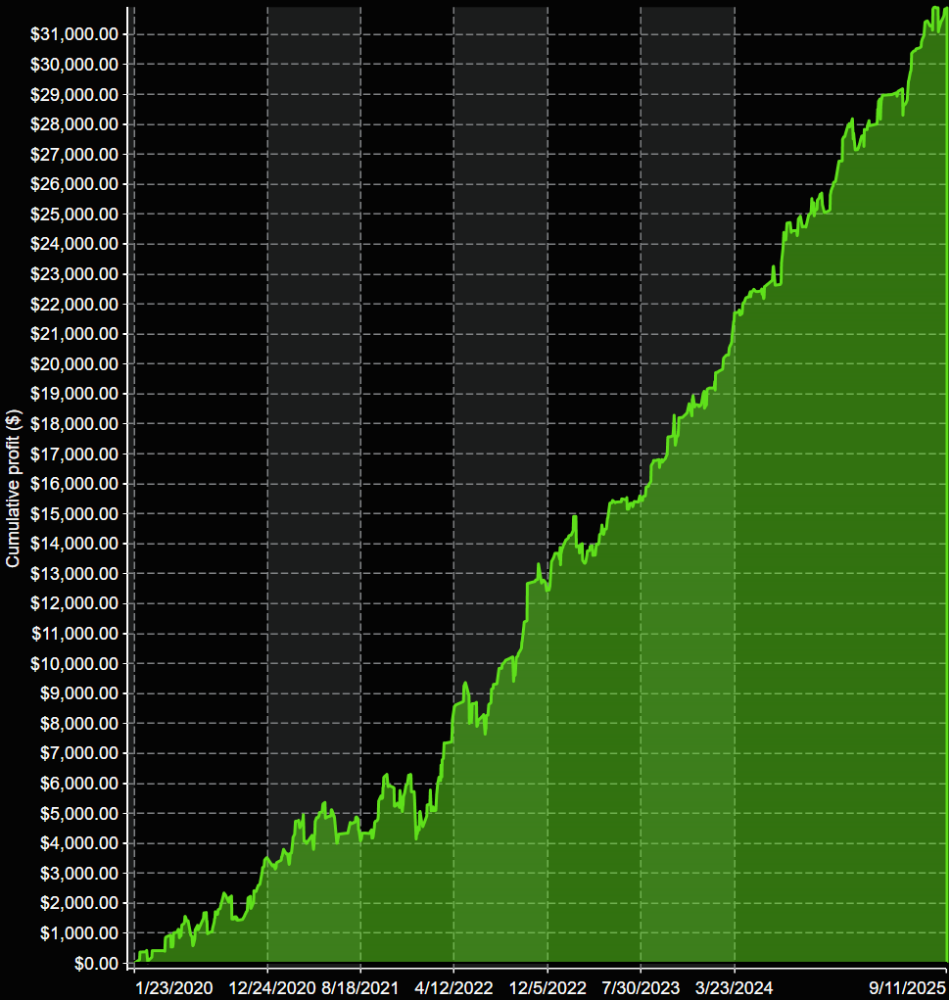

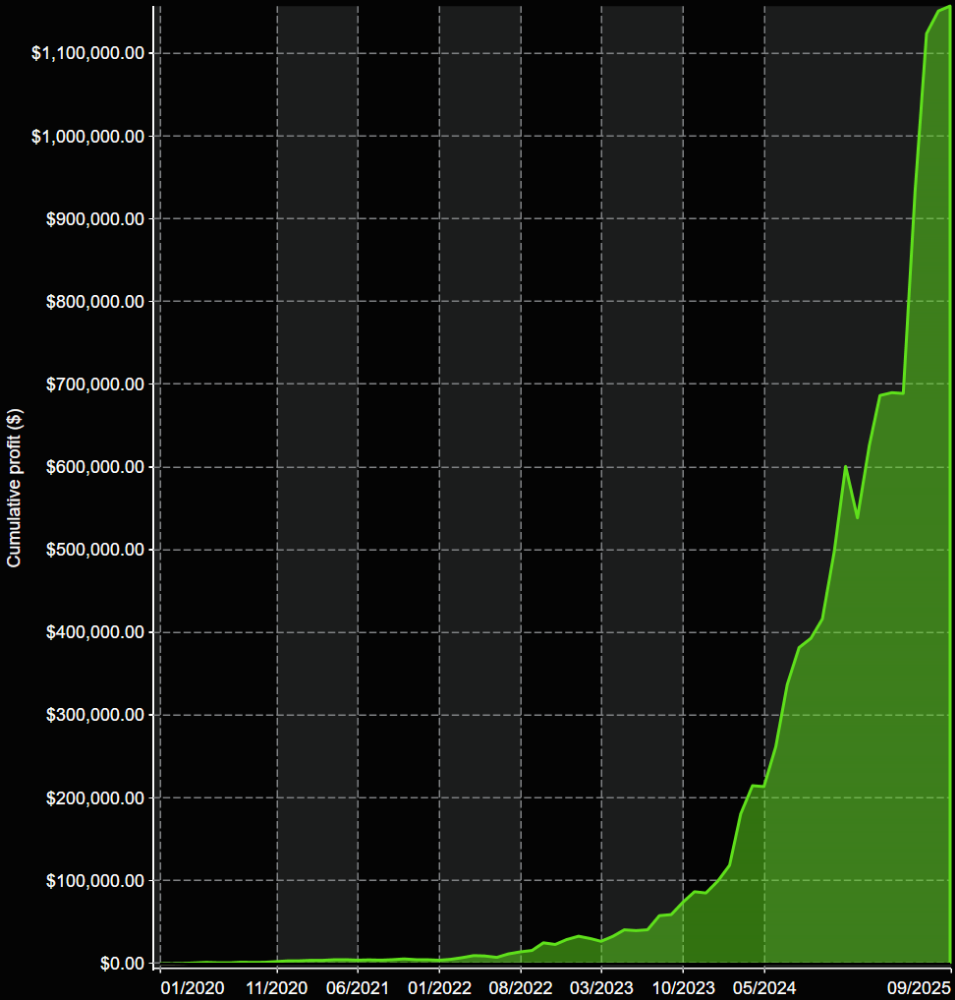

THE POWER OF COMPOUNDING

So far all results presented are always trading the same number of contracts. This is fine for generating income. Another way to go is to keep the money earned in the account and use it to trade more contracts.

BELOW: CUMMULATIVE NET PROFIT TRADING WITH 2 MNQ CONTRACTS AND THEN ADDING CONTRACTS AS RETURNS COME IN. RESULTS INCLUDE COMMISSIONS AND SLIPPAGE.

Contract: MNQ 12-25. Trade List

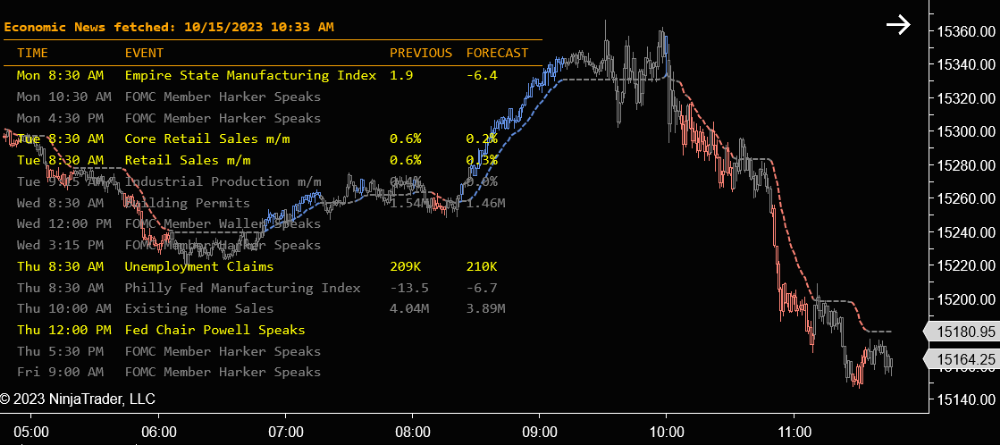

Automatic News Retrieval

The VX9 is not limited just to algorithmic price series analysis. The market reacts when scheduled news is released. The VX9 trades around these events by closing positions before, pausing trade entries or not trading at all. We rigorously tested these decisions on a historical database and found that by avoiding these events in the way that we do the performance of the system is measurably enhanced. News events that are scanned for include:

- Weekly Unemployment Claims

- Monthly Jobs Report

- FOMC Policy Decisions

- FOMC Chairman Speeches

- Annual Economic Forum at Jackson Hole

You don’t need to do anything special to activate this feature. It is fully automated for both back testing and real time trading.

We provide, for free, in the VX9 package a news reader indicator that lets you view news events on your chart.

VX9 Runtime Settings

The VX9 indicators and strategies offer customizations that affect visualization as well as actual trading.

The trading customization let you decide:

- The days of the week to trade

- Time of day to start and stop trading

- Number of contracts to trade long or short

- NinjaTrader Stop Loss or Trailing Stop Loss

- Daily and Weekly Profit Target - stops trading when reached

- Daily and Weekly Loss Limit - stops trading when reached

VX9 Swing Analysis

Price action swing analysis enables the VX9 to find optimal stop loss and price targets. Stop and target features:

- Price Action Swing analysis or price move percentage

- Stop Loss based on swings or price move percentage

- Target based on swings or price move percentage

- Trailing Target

- Trailing Stop loss

Settings in the VX9 allow you to customize how it's features work. Many combinations are possible.

Strategy Analyzer®and Market Replay®

All customization choices affect performance metrics. You can see the effect of your choices by running the VX9 in the Strategy Analyzer® or Market Replay®.

What's in the Box?

You will receive the system via email approximately one business day after purchase.

The email will go to the one associated with your PayPal account unless you ask for delivery elsewhere. Check your SPAM or JUNK mail folder.

You’ll receive several artifacts of the VX9 Trading System:

- NinjaTrader® import file that contains the VX9 Trading System. This can be imported into NinjaTrader® using the Tools -> Import -> NinjaScript-AddOn... utility within NinjaTrader®. Once imported you’ll be able to run the VX9.

- PDF file containing a manual that explains how to install and use the VX9 trading system in detail.

Don't have NinjaTrader®?

Try it for free, complete with free realtime data.

HERE is where you can get the FREE NinjaTrader® platform.

Continued Support and Updates for a Minimum of 12 Months

We continue to maintain the products you buy from us after your purchase. You’ll get full support and updates for at least one year after purchase. If you have any problems or require any additional information you can contact us for assistance.

Don’t hesitate to contact us questions about any of our products.

VX9 Trading System and Indicator Set for NinjaTrader®

The VX9 trading system automatically finds trading opportunities in NASDAQ 100 futures market accessible in NinjaTrader. Fully automated system automatically execute trades.

Available for immediate online delivery from: AutomaticTradingSignals.com